This week was pretty quiet; there was a lot of "wait and see" with the FOMC meeting minutes, a bunch of Fed related speeches, the beginning of earnings and so forth. And then things took off and the market as a whole ended up about 2%.

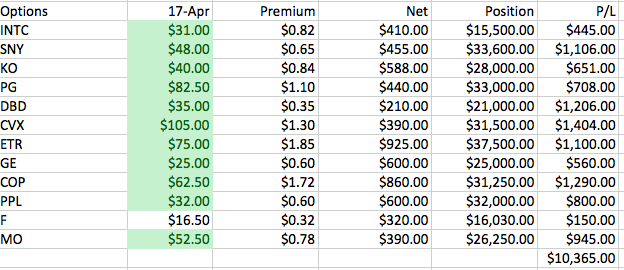

The Intel bid for Altera fell through, but the biggest news was GE selling off most of it's financial assets. As a result, 11 of my 12 positions are in the money:

As I mentioned last week the big lesson so far has been "Don't Get Greedy For Premium". That greediness manifested itself in the state of the portfolio. That creates an unnecessary level of trading in an account that I want to keep as stable as possible. I still want to capture a nice level of premium, so for this coming month I'm planning to write covered calls that are:

- A bit more "out of the money"

- Two months in the future rather than one

There's a small increase in the combined dividend yield to 3.71% from 3.65%. Finally, the changes will (I hope) reduce the number of re-purchases I have to execute. Since this is an IRA there are no tax consequences for short term sales, but each purchase does cost something in commissions.

Going two months out also means I need companies that fit my strong dividend profile and have very active options markets. In addition I want to decrease my exposure to oil and electric utilities, and make a few other adjustments:

- Drop CVX - reduce Oil exposure

- Replace SNY with MRK - eliminate exposure to ADR fees and currency risk

- Replace INTC with EMR - more diversified products, less dependent on CPUs

- Replace DBD with STX - more active options, products I understand

- Drop PPL - reduce Electric Utilities exposure

Anyway... next week is expiration (though my F position doesn't expire until the 24th) and we'll finally find out how well this whole thing is actually working.

No comments:

Post a Comment