Saturday, April 25, 2015

Financial Planning: Weekend Update - April 25, 2015

The first week of the revised portfolio is in the books and we're doing pretty well. As you can see, only three positions are "in the money" (ITM). Of those Verizon only by $0.03 and ED closed exactly at $62.50. We've also got some paper losses totaling $1520.00 or 0.44% of the portfolio value. That's not too bad, but it is a little annoying for a week as "up" as this one was.

F, as expected, expired "out of the money". For now I have no plans to try to squeeze any more premium from that position; with the 3.8% dividend I don't mind being patient.

Now, this portfolio is one I want to hang on to (unlike last month). So that gives me the opoportunity to mention a strategy for just that situation: the "roll out". If, for example, VZ were to be trading at $50.03 on May 15, the price of the May 15 $50 call will be very close to that 3 cents (as a retail customer I'll be lucky to get it for a nickle). The June $50 will be about $0.80. Since I don't want my VZ to be assigned (and it will be even if it's only a penny in ITM) I can simultaneously buy back the May $50 and sell the June $50, earning that $0.80 in fresh premium or $560.00.

The strategy will cost me some commissions: $8.95 plus $0.75 per contract each way for a total of $28.40. If I let the 700 shares of VZ be assigned I'd pay $8.95 on the sale of the underlying VZ, $8.95 to repurchase the stock for at least $0.92 more than I paid when I opened the position and then another $14.20 to write the calls for a total of $32.10 in commissions plus whatever the new price of VZ happens to be on that Monday. By rolling out I preserve my original cost basis and save a little bit in commissions.

This strategy can be applied to any ITM position but it's particularly effective when the underlying is barely ITM - the cost to buy back your calls is minimal compared to the new premium. And of course there's no need to sell those "at the money" new calls - you can "roll up" to a higher strike and simultaneously collect premium as well as additional capital appreciation.

Monday, April 20, 2015

Financial Planning: Options Monday - April 20, 2015

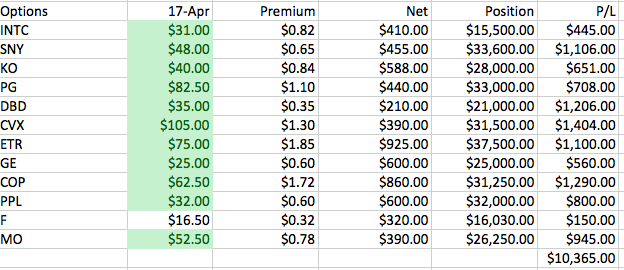

As I indicated Friday all but two positions closed in the money and would have been assigned. Shown above are the new equity positions I've taken. As you can see there have been a lot of changes, I hope for the better. There were two un-assigned positions: F and MO. F doesn't expire until April 24 and it's pretty unlikely to be assigned at this point. I purchased another 100 shares of MO, modestly increasing my cost basis by $0.12 per share.

The spreadsheet above shows the calls I wrote, along with the net premium income for each. I'm now including commission cost in my totals. When I started this project I was pretty sure I'd be able to swing a deal for some number of free trades but based on subsequent reading that's looking less likely.

Finally we have my current cash position. The columns are as follows:

- Income - Cash from Dividends and Premiums

- Exercise - Cash from assigned positions

- Repurchase - Cost to re-enter core positions that were assigned

- New Purchase - Cost of additional stock purchases

- Distribution - Cash withdrawn as an IRA distribution

What to do about F? I'm willing to be patient with F given that 3.8% dividend. My cost basis is $16.20 and while I'm not unwilling to average down, I'd need to see $15.80 or and even so I'd have to double my position. That would at least bring it into line value-wise with the rest of the portfolio. I expect I'll buy in bits and piece whenever there's a sustained dip under $15.80.

Finally, It's my goal to have about $40,000 available in cash as an "emergency fund" and were I actually retired would be taking a distribution of about $1,800 each month until my full retirement age of 67 when I'll start Social Security. At that point I'll set everything to DRIP and continue to write calls, though probably at a much reduced pace while maintaining roughly equal positions in each underlying.

Saturday, April 18, 2015

Financial Planning: Weekend Update - April 18

What a week! On Monday the market basically gave up Friday’s gains, Tuesday and Wednesday got ‘em back, Thursday was pretty much flat and then the bottom fell out on Friday. By 3:00 every single stock in my portfolio was in the red and by closing the market as a whole was down about 1.5%

The only OTM positions were F and MO - no surprise there. As a result I had the opportunity to do the major restructuring I mentioned last week. The portfolio position as a whole showed a gain of 3.4% for the 5 weeks it’s been active.

What to do now? I've got $288,350 in cash from the assigned positions plus the $7,209.50 in dividends and premium from my March activity. I've got 1000 shares of F, now worth $15, 760 and 500 shares of MO worth $25875.00 for a total of $329,95o. Add in the $7609.50 in option premium and dividends for a total of $337,594.50. That's a net gain of $11,141.50 or 3.41% for the 5 weeks I've had this position. Note that the F position still has another week until it expires so I'm just going to let it ride until then.

So... as I mentioned last week I'm re-allocating into 10 positions of roughly equal dollar value:

Ordinarily when establishing a covered call position with new underlying you want to place what's called a "buy/write" order. You won't save anything in commissions but you get the price you want on the position as a whole. And that's what I'd normally do. But since this is paper trading I'm going to use this methodology: Buy the Underlying at the open. Use the bid price as soon as each underlying rotates in.

Check back Monday evening to see where things stand!

Saturday, April 11, 2015

Financial Planning: Weekend Update - April 11

This week was pretty quiet; there was a lot of "wait and see" with the FOMC meeting minutes, a bunch of Fed related speeches, the beginning of earnings and so forth. And then things took off and the market as a whole ended up about 2%.

The Intel bid for Altera fell through, but the biggest news was GE selling off most of it's financial assets. As a result, 11 of my 12 positions are in the money:

As I mentioned last week the big lesson so far has been "Don't Get Greedy For Premium". That greediness manifested itself in the state of the portfolio. That creates an unnecessary level of trading in an account that I want to keep as stable as possible. I still want to capture a nice level of premium, so for this coming month I'm planning to write covered calls that are:

- A bit more "out of the money"

- Two months in the future rather than one

There's a small increase in the combined dividend yield to 3.71% from 3.65%. Finally, the changes will (I hope) reduce the number of re-purchases I have to execute. Since this is an IRA there are no tax consequences for short term sales, but each purchase does cost something in commissions.

Going two months out also means I need companies that fit my strong dividend profile and have very active options markets. In addition I want to decrease my exposure to oil and electric utilities, and make a few other adjustments:

- Drop CVX - reduce Oil exposure

- Replace SNY with MRK - eliminate exposure to ADR fees and currency risk

- Replace INTC with EMR - more diversified products, less dependent on CPUs

- Replace DBD with STX - more active options, products I understand

- Drop PPL - reduce Electric Utilities exposure

Anyway... next week is expiration (though my F position doesn't expire until the 24th) and we'll finally find out how well this whole thing is actually working.

Wednesday, April 8, 2015

Financial Planning: Weekend Update - April 4

Late post due to vacation (Vegas Baby!).

This was a pretty schizophrenic week, shortened by the Good Friday market holiday. Monday was a huge up day on news of health care merger activity, China hinting at stimulus, and a 3.1% gain in pending home sales. That was followed by a Tuesday where the market gave back half of Monday's gains. Wednesday the S&P was down a bit and Thursday gained back Wednesday's drop. After all that the S&P ended up down about 10 points for the week.

At the end of it all my portfolio closed with half the positions still "in the money". Some like CVX just barely ITM and others, like PG just barely OTM. I think the principal lesson after 3 weeks is:

- Don't Get Greedy For Option Premium

As I mentioned last week I plan to eliminate one of the Oil's and while I was going to re-purchase ETR (should it be assigned) I'm now leaning toward changing my electric utility allocation to ED and switching out DBD for EMR. That will leave me with 10 positions and I'll allocate the remaining funds so that everything is more or less equally weighted.

Subscribe to:

Posts (Atom)